Group purchasing organizations and integrated delivery networks account for the lion’s share Ð somewhere between 72 percent and 80 percent Ð of hospitals’ and nursing homes’ total non-labor expenditures.

This is among the findings of “A Cost Savings and Marketplace Analysis of the Health Care Group Purchasing Industry,” a new report commissioned by the Health Industry Group Purchasing Association (HIGPA). The report was researched and written by Muse & Associates in Washington, which produced reports in 2000 and 2002 for HIGPA on the role of group purchasing organizations in U.S. healthcare.

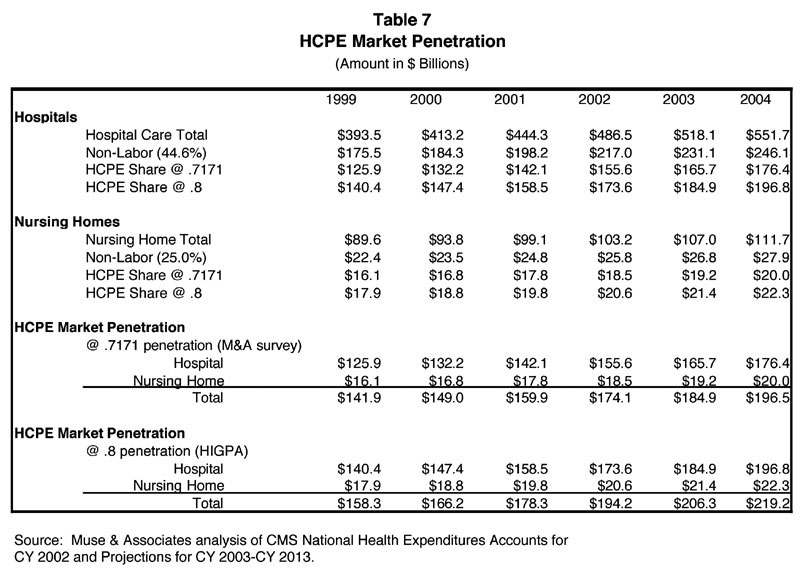

The report puts GPO and IDN spending in the perspective of national healthcare spending. Total U.S. healthcare expenditures in 2004 are estimated to have been $1.8 trillion, or 15.5 percent of the gross domestic product, according to the Centers for Medicare and Medicaid Services. Together, the total marketplace for healthcare purchasing entities (or HCPEs, which is HIGPA’s term for IDNs and GPOs) for 2004 fall somewhere between $196.5 billion and $219.2 billion, or about 10 percent to 12 percent of total national health expenditures.

Last year, hospitals accounted for $551.7 billion, or about 36 percent, of all spending on health services and supplies. Community hospitals were responsible for $9 of every $10 spent on hospital services. Meanwhile, expenditures for freestanding nursing homes totaled $111.7 billion, or about 6.8 percent of all spending on health services and supplies. Medicaid pays for the majority of this care.

CMS predicts total national healthcare expenditures will increase to $3.4 trillion by 2013, nearly 18.5 percent of the gross domestic product. Of that, about $934.3 billion will be hospital care expenditures. Total nursing home expenditures are projected to increase to $116.9 billion in 2005, and to $184.8 billion in 2013.

Supply chain spending

Hospital non-labor expenditures (medical equipment, supplies, pharmaceuticals, food, etc.) in 2004 are estimated to have been $246.1 billion, or 44.6 percent of hospitals’ total expenditures. Being more labor-intensive than hospitals, nursing homes spend a higher proportion (75 percent) of their expenses on labor, and a smaller proportion (25 percent) on non-labor categories. In 2004, therefore, nursing homes’ estimated non-labor expenditures were $27.9 billion. The total potential marketplace for GPOs and IDNs is the sum of these two numbers, or $274 billion, according to the Muse study.

Pharmaceuticals and medical-surgical equipment and supplies are two of the major commodity groups that IDNs and GPOs handle. The Muse study says hospital expenditures for pharmaceuticals in 2004 totaled about $30.1 billion (12.25 percent of non-labor spending), while nursing homes spent $2.2 billion (8 percent of non-labor spending) on pharmaceuticals. Meanwhile, hospitals are estimated to have spent about $46.8 billion (19 percent of non-labor expenditures) for medical-surgical supplies and equipment in 2004, while nursing homes spent $2 billion (7 percent of non-labor expenditures). Hospitals and nursing homes spent a total of $81.2 billion on pharmaceuticals and medical-surgical supplies and equipment in 2004, with hospitals accounting for 95 percent of the total, and nursing homes 5 percent.

About 72 percent to 80 percent of hospitals’ and nursing homes’ non-labor expenditures are funneled through GPOs or IDNs, according to HIGPA and various provider organizations. Using those figures, somewhere between $176.4 billion and $196.8 billion of hospitals’ non-labor expenditures in 2004 were acquired through GPO and IDN contracts. For nursing homes, the range was between $20 billion and $22.3 billion.

Impact of group purchasing

Having been commissioned by HIGPA, it’s no surprise that the Muse study looks at the impact of group purchasing on healthcare purchasing. According to Muse, GPOs and IDNs racked up between $21.8 billion and $38.7 billion in savings in 2004. (That figure is based on estimates that GPO and IDN contracts save hospitals between 10 percent and 15 percent off their purchase prices.)

Additional governmental restrictions on IDNs and GPOs could cut those savings substantially, according to the study. “As more and more restrictions are placed on the operations of a Ôfree’ market, the costs of Ôdoing business’ will likely increase,” say the study’s authors. “Restricting the contracting processes and operations of HCPEs or shifting costs will result in higher prices, erosion of current discounts and a decline in savings that HCPEs provide.”

A decline of just 1 percentage point in GPO- and IDN-generated savings in 2004 would have resulted in an increase in total public and private expenditures for health services and supplies of between $2.18 billion and $2.58 billion, according to the study. Medicare alone would have spent an additional $613 million to $725 million, while the Medicaid program would have incurred additional costs of $43 million to $425 million.

“Additional restrictions such as caps on vendor payments, new certification requirements, expanded administrative oversight, increased record keeping and reporting requirements will increase costs for HCPEs, their members and their trading partners,” say the study’s authors. “This will erode discounts and add significant costs to the healthcare system without providing any new protections to providers, patients, third-party payers, etc.”