Prime Vendor: Getting the Most from Your Most Important Supplier

By Jeff Girardi, HIDA

For most healthcare organizations, physician preference items (PPI) account for a significant portion of spending and are rife with logistics inefficiencies. Historically, PPI management was not an area typically supported by full-line distributors. However, recent HIDA research suggests more hospitals are looking to their prime vendor distributor to manage PPI purchases in order to reduce cost and waste

For most healthcare organizations, physician preference items (PPI) account for a significant portion of spending and are rife with logistics inefficiencies. Historically, PPI management was not an area typically supported by full-line distributors. However, recent HIDA research suggests more hospitals are looking to their prime vendor distributor to manage PPI purchases in order to reduce cost and waste

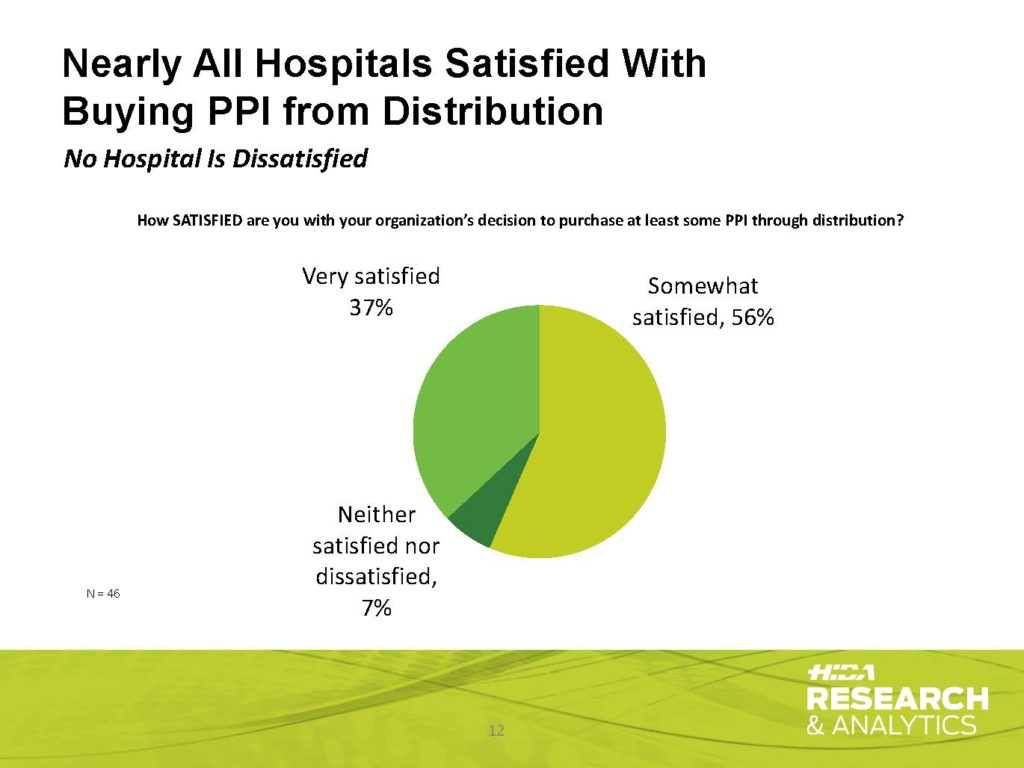

HIDA’s 2017 Acute Care Market Survey of hospital CFOs and supply chain executives finds nearly half of all hospitals have explored purchasing PPI through their distributor, and 90 percent of those organizations decided to move forward with such partnerships. Satisfaction rates among those that pursue PPI purchasing models with distributors validate their decision; 93 percent are somewhat or very satisfied, while none are dissatisfied.

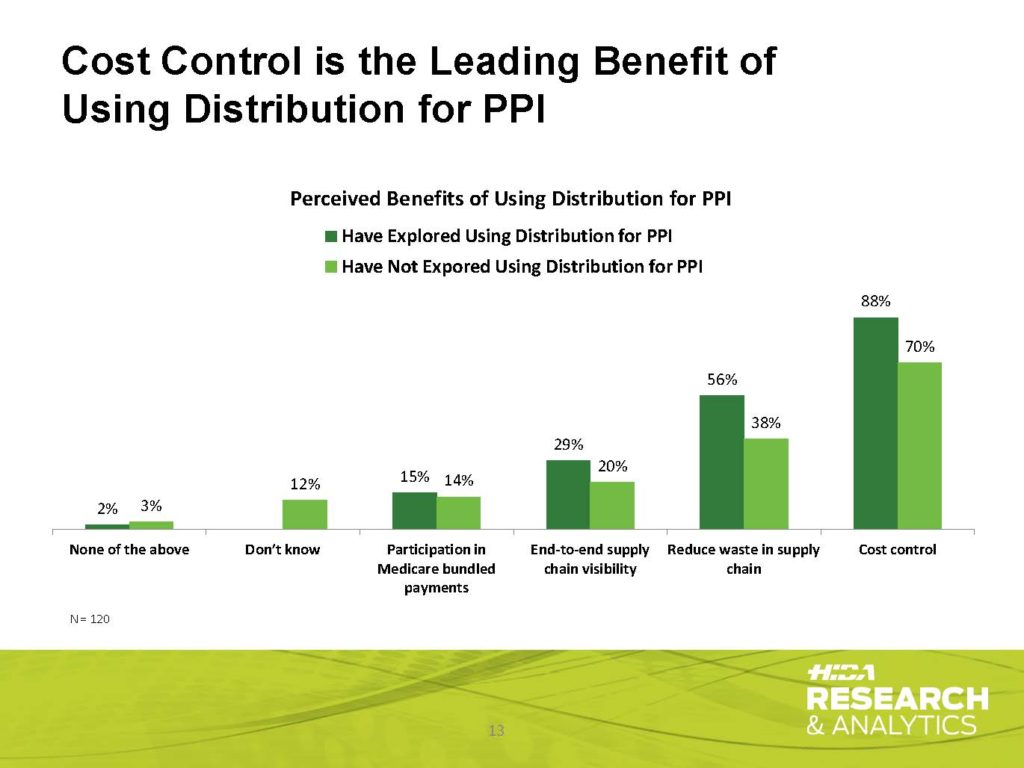

Whether or not a hospital uses a distributor for PPI, a majority of providers agree that cost control is the leading benefit of doing so. For those that have explored purchasing PPI through distribution, 56 percent also identified reducing supply chain waste as a secondary benefit (see Chart 2 below). Hospitals remain most challenged by bottom line performance — a statement reinforced by the fact that the top three challenges survey respondents face this year are reimbursement, reducing operating costs, and meeting budget targets.

Still, not all providers are convinced or able to utilize distribution for PPI management. Physician opposition presents a significant barrier for both those that have or haven’t explored such paths. And implementation costs weigh heavily on those that have yet to consider distributor PPI partnerships, yet this could simply be a misperception judging by the experience of those that actually pursue these agreements.

PPI management also requires a certain level of expertise needed to navigate product complexities, specialized training, or liability risks associated with certain items. The good news is that the distribution channel annually invests billions in IT, supply chain technology, and other infrastructure to continuously improve and innovate solutions across the care continuum, providing an ideal PPI environment that’s poised for future growth.

Only 19 percent of all physician preference items are purchased through distributors at present, leaving ample room for hospitals to explore. For those that have already pursued this route, half plan to expand their volume of PPI purchased through distribution while another 20 percent are unsure.

Visit www.HIDA.org/Infographics to access our free “Distributors Reduce PPI Supply Chain Costs” infographic for more on this research.